1. Introduction

In today’s ever-changing job market, making smart career decisions is crucial for long-term success and financial stability. However, many individuals overlook the importance of financial planning when it comes to their career choices. By utilizing proper career counseling and financial planning strategies, individuals can ensure that they make informed decisions that align with their financial goals and aspirations.

This article explores the significance of financial planning in making smart career decisions and offers valuable insights for individuals seeking to achieve financial success in their chosen career path.

2. The impact of financial planning on career decisions

Financial planning plays a pivotal role in making smart career decisions as it provides individuals with a clear understanding of their financial goals and the necessary steps to achieve them. When individuals have a comprehensive financial plan in place, they can make informed career choices that align with their long-term financial objectives.

By considering factors such as salary potential, job stability, and growth opportunities, financial planning helps individuals identify career paths that offer the best financial prospects. Moreover, it also helps individuals make thoughtful decisions regarding education and training, ensuring that they invest their time and resources in areas that will yield the greatest return on investment.

In addition, financial planning enables individuals to better manage their income, expenses, and debt, allowing them to make career decisions based on financial stability rather than short-term financial constraints. Overall, the impact of financial planning on career decisions cannot be overstated, as it empowers individuals to make choices that will lead to long-term financial success and fulfillment in their chosen profession.

3. Assessing your financial goals and priorities

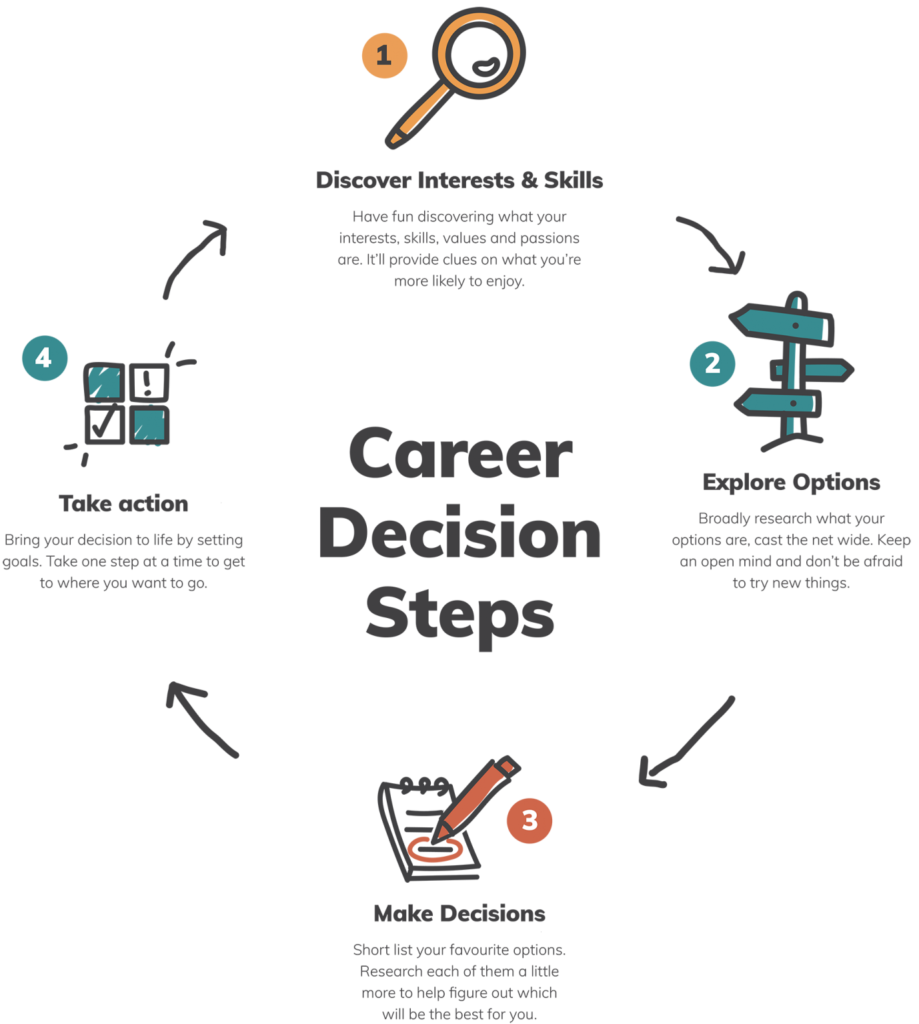

Assessing your financial goals and priorities is a crucial step in financial planning and making smart career decisions. Understanding what you want to achieve financially will help you align your career choices with those goals.

Start by identifying your short-term and long-term financial objectives. Do you want to save for a down payment on a house, pay off student loans, or start a retirement fund? Knowing your financial aspirations will guide you in selecting a career path that can support these goals.

Consider the importance of work-life balance and job satisfaction in your financial planning. While high-paying jobs may seem tempting, they may come at the cost of long hours and high levels of stress. Assessing your priorities will help you strike the right balance between financial success and personal fulfillment.

Take into account your risk tolerance and desired level of financial security. Some individuals may be comfortable taking on more risk in their careers, while others prefer stability and job security. Understanding your financial risk appetite will aid in narrowing down career options that align with your comfort level.

By assessing your financial goals and priorities, you can make informed career decisions that not only offer financial stability and growth but also align with your personal values and aspirations. Stay tuned for the next section, where we will discuss the importance of budgeting in financial planning for career decisions.

4. Understanding the long-term implications of your career choices

Understanding the long-term implications of your career choices is essential in financial planning. It’s important to consider how your chosen career path will impact your financial situation in the future.

Think about the potential for career growth and advancement within your field. Will your chosen career provide opportunities for salary increases or promotions? Research the earning potential of your desired profession to ensure that it aligns with your long-term financial goals.

Consider the impact of your career on your retirement planning. Will your chosen career offer retirement benefits such as pension plans or 401(k) contributions? These factors can significantly impact your financial security in the later stages of your life.

Additionally, think about the job market demand for your chosen career. Is it a growing industry with ample job opportunities, or is it a declining field? Assessing the stability and future prospects of your chosen career can help you make more confident financial decisions.

By understanding the long-term implications of your career choices, you can align your financial planning with your professional aspirations and ensure a secure and prosperous future. In the next section, we will explore the importance of creating a financial contingency plan in case of unforeseen circumstances. Stay tuned!

5. Budgeting and managing expenses for career transitions

Budgeting and managing expenses for career transitions is a crucial aspect of financial planning. When making smart career decisions, it’s essential to consider the financial implications of any changes or transitions you may encounter.

Firstly, assess the potential costs associated with a career transition. Will you need to invest in new certifications, education, or training to pursue your desired career path? Research and budget for these expenses to ensure that your financial resources can cover them.

Additionally, consider the potential impact on your income during a career transition. Will there be a period of time where you may experience a reduction in earnings or no income at all? This is important to factor into your financial planning to ensure that you have sufficient savings or an alternative income source during the transition phase.

When managing expenses during a career transition, it’s crucial to prioritize and cut unnecessary expenses. Evaluate your current spending habits and identify areas where you can make adjustments to free up funds for your career transition.

Creating a detailed budget that includes all your essential expenses, such as housing, utilities, and transportation, will help you allocate your resources effectively. Make sure to leave room for potential unexpected expenses that may arise during the career transition process.

Finally, remember to reassess your financial goals and make adjustments as necessary to accommodate your new career path. This may include adapting your savings strategy, revising your retirement plans, or reassessing investment options.

By budgeting and managing expenses during career transitions, you can ensure that your financial health remains intact while pursuing your professional goals. In the following section, we will discuss the importance of building an emergency fund to enhance your financial stability. Stay tuned!

6. Utilizing professional financial advisors for guidance

Utilizing professional financial advisors for guidance

While managing your own financial planning during career transitions is possible, seeking guidance from professional financial advisors can provide valuable insight and expertise. These professionals are well-versed in the intricacies of financial planning and can provide tailored advice based on your specific circumstances.

A financial advisor can help you navigate the potential complexities of budgeting and managing expenses during a career transition. They can provide a comprehensive analysis of your financial situation and help you create a solid plan that aligns with your short-term and long-term goals.

Moreover, financial advisors can assist in identifying potential risks and opportunities related to your career transition. They can help you determine the best strategies to maximize your financial resources while minimizing risks.

Working with a financial advisor can also help you stay disciplined and accountable to your financial goals. By having someone to regularly monitor and assess your financial progress, you are more likely to stay on track and make informed decisions.

Remember to choose a financial advisor who is reputable and experienced in career transitions. Seek recommendations from trusted sources, and don’t hesitate to schedule initial consultations to ensure they understand your unique circumstances.

Financial advisors can be a valuable asset in making smart career decisions by assisting in budgeting, managing expenses, and providing expert advice. In the next section, we will explore the importance of setting realistic financial goals during career transitions. Stay tuned for more valuable insights!

7. Achieving peace of mind and financial stability through effective planning

Achieving peace of mind and financial stability through effective planning

Career transitions can bring uncertainty and anxiety, especially when it comes to finances. However, with the help of effective financial planning, you can achieve peace of mind and financial stability during these transitions.

By setting realistic financial goals, you can have a clear vision of what you want to achieve in your career and how your finances can support those goals. Whether it’s saving for further education, starting your own business, or transitioning into a new industry, having a plan in place will give you a sense of direction and purpose.

Financial planning also allows you to evaluate your current financial situation and make necessary adjustments. It helps you create a budget that aligns with your new career path, ensuring that you can cover your expenses, save for the future, and adapt to any unexpected challenges that may arise.

Moreover, effective planning enables you to make informed decisions about your investments and retirement savings. It ensures that you are maximizing your financial resources and taking advantage of any available opportunities.

By having a solid financial plan, you can feel secure in the knowledge that you are making smart career decisions that align with your long-term financial goals. It provides you with the confidence and stability needed to navigate the uncertainties of a career transition.

In the upcoming section, we will discuss the importance of building an emergency fund and having a safety net to protect your finances during career transitions. Stay tuned for more valuable insights on financial planning!

8. Conclusion: The power of financial planning in career success

Building an emergency fund and having a safety net to protect your finances during career transitions is crucial. This final section will emphasize the power of financial planning in achieving long-term career success.

Without a solid financial plan, unexpected events such as job loss or a significant decrease in income can be financially devastating. However, by having an emergency fund, you can ensure that you have enough money to cover your expenses and maintain stability during these challenging times. This not only provides peace of mind but also allows you to focus on finding the right career opportunities without the added stress of financial uncertainty.

Additionally, having a safety net in the form of insurance coverage, such as health and disability insurance, can further protect your finances in case of unexpected events. These safeguards give you the confidence to take calculated risks and make smart career decisions that can lead to long-term success.

In conclusion, financial planning plays a vital role in making smart career decisions by providing a sense of direction, stability, and protection. It allows you to set realistic goals, adapt to changes, and take advantage of opportunities. By prioritizing financial planning, you are giving yourself the best chance at achieving both career and financial success.